December 20, 2023

ACH vs. Pay by Bank: Understanding the Dynamics of Modern Payment Systems

Dive into the future of finance with our latest article! Explore how ACH and Pay by Bank are revolutionizing payments in the U.S. Get insights on their growth, impact, and what it means for you.

The Automated Clearing House (ACH) network, established in the 1970s, represents a pivotal shift in the United States' payment systems, moving from check-based to electronic transactions. As a cornerstone of U.S. financial infrastructure, ACH facilitates a substantial portion of the nation's monetary transfers, including over 93% of American workers' salaries through direct deposit. This prevalence underscores ACH's role as a crucial component of the U.S. economy.

ACH Payments: A Comprehensive Analysis

Historical Context and Growth

Originally designed to reduce the reliance on paper checks, ACH's introduction marked a significant innovation in payment processing.

ACH transactions have seen a consistent upward trajectory. For instance, in 2019, the network processed approximately 24.7 billion transactions, a notable increase from 23 billion in 2018, as reported by Nacha.

The growth continued, with 2022 witnessing a remarkable 30 billion transactions, emphasizing the network's expanding footprint in the financial landscape.

Versatility and Cost-Efficiency

ACH's applications are diverse, ranging from individual to business transactions, encompassing direct deposits, vendor payments, and customer invoicing.

Compared to other payment methods like wire transfers (which can cost $15-$30 per transaction domestically) and credit card processing fees (typically 1.5% to 3.5% per transaction), ACH stands out for its lower costs, often mere cents per transaction.

This cost efficiency makes ACH particularly attractive for businesses, which can save substantial amounts annually on transaction fees.

Operational Mechanics

ACH operates on a batch processing system, where transactions are accumulated and processed at set intervals throughout the business day. This system, while efficient, typically means ACH transactions take 1-3 business days to complete.

The network operates under strict regulatory oversight, ensuring high standards of security and reliability in transactions.

The ACH Network's Infrastructure

Federal Reserve and Nacha:

The Federal Reserve, as a primary operator, processed 62.2% of ACH volume in 2020, with the remaining handled by private-sector operators. Nacha, governing the ACH network, enforces rules and standards, with recent updates in 2023 focusing on enhancing security protocols and expanding network capabilities.

Third-Party Payment Processors and Banks:

Companies like PayPal and Stripe are part of a growing market of fintech firms providing ACH services, reflecting the digitization of financial services. Banks and credit unions, through partnerships or proprietary systems, offer ACH services, contributing to the network's ubiquity.

ACH Transaction Process

Authorization and Initiation:

The transaction begins with authorization, where the payee consents to the transaction, followed by the payer initiating the transaction.

Processing and Settlement:

Processing involves routing the transaction through the ACH network, with settlement occurring when funds are transferred. This phase's duration is a critical consideration for businesses managing cash flows.

Confirmation:

The final step is the confirmation, where both parties receive notification, often electronically, ensuring transparency and record-keeping.

Pay by Bank: An Emerging Trend

Integration with ACH and Open Banking

Pay by bank represents a synthesis of ACH's robustness with the agility of open banking, facilitating direct transfers from consumer bank accounts to merchants.

This method has seen increased adoption in e-commerce, where seamless and secure transactions are paramount.

Operational Dynamics and Market Growth

The process includes bank verification and authorization, ensuring the security of transactions without sharing sensitive data.

While still nascent in the U.S., global markets have seen wider adoption, with fintech companies driving innovation and integration.

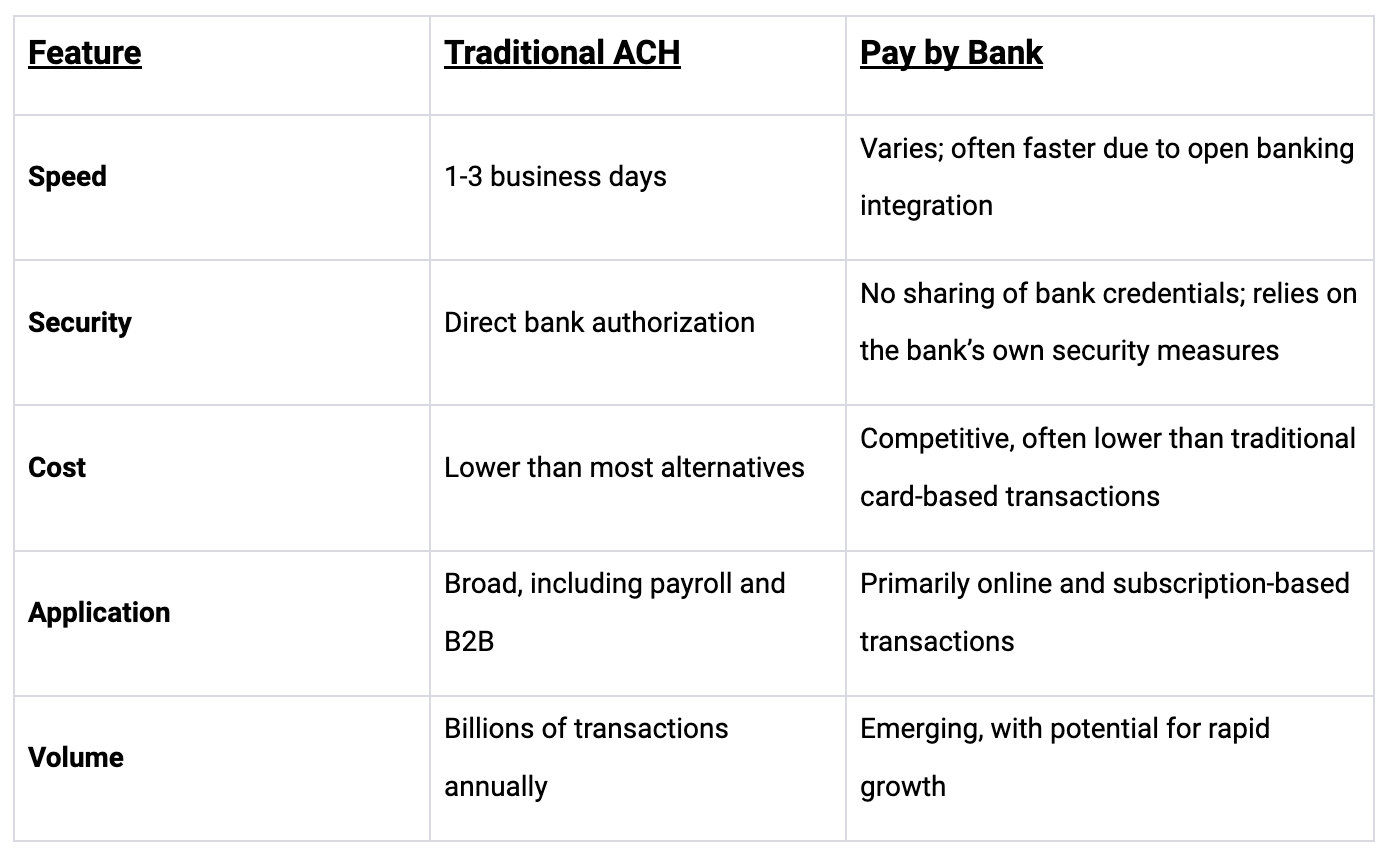

Comparative Analysis: Traditional ACH vs. Pay by Bank

Strategic Considerations and Future Outlook

As businesses and individuals navigate the evolving landscape of financial transactions, the choice between ACH and pay by bank hinges on factors like transaction volume, speed requirements, and cost considerations. The integration of technology in financial transactions, as seen in the rise of pay by bank, points to a future where efficiency and security are paramount.

Businesses, in particular, must weigh the benefits of traditional ACH, with its established track record and reliability, against the emerging advantages of pay by bank, which offers enhanced speed and user experience, particularly in online and e-commerce settings.

Future of Financial Transactions

The trend towards digital and automated payment systems is likely to continue, with both ACH and pay by bank playing pivotal roles.

Innovations in financial technology, such as blockchain and real-time payment systems, are poised to further revolutionize the way payments are processed, potentially reducing transaction times and increasing security.

Market Dynamics and Consumer Behavior

Consumer preference for digital and contactless payment options, accelerated by global events like the COVID-19 pandemic, has shifted the market towards more innovative solutions like pay by bank.

A 2021 survey indicated that over 50% of U.S. consumers prefer electronic payment methods over traditional ones, signaling a growing market for pay by bank and similar technologies.

Regulatory and Compliance Aspects

Regulatory frameworks continue to evolve, with a focus on protecting consumer data and preventing fraud. Compliance with these regulations is a critical consideration for businesses adopting new payment methods.

The role of agencies like the Consumer Financial Protection Bureau (CFPB) in the U.S. is significant in shaping the future of payment systems, ensuring they are fair, transparent, and secure.

The landscape of payment methods is dynamic, with ongoing innovations and adaptations. Staying abreast of these changes is crucial for both businesses and consumers. As technology continues to advance, the integration of AI, machine learning, and enhanced cybersecurity measures will likely play a significant role in the future of payment processing, making transactions faster, more secure, and more user-friendly.

To discover how Lynk can help your business grow and keep you ahead of the curve, get in touch with us today by clicking here.